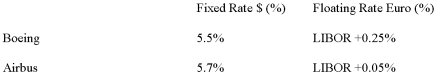

The following information is given.  Boeing and Airbus have agreed to swap their debt payments so that each firm gets its preferred debt terms.Each firm will save the same amount in percentage terms.

Boeing and Airbus have agreed to swap their debt payments so that each firm gets its preferred debt terms.Each firm will save the same amount in percentage terms.

a)Does Boeing prefer fixed or floating rate debt?

What rate does it pay on its preferred debt?

b)Does Airbus prefer fixed or floating rate debt?

What rate does it pay on its preferred debt?

c)What are the total interest savings available in this interest rate swap?

d)Which company has the advantage in fixed rate debt?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: The term interest rate swaps:

A) refers to

Q16: Company A swaps fixed-rate US dollar debt

Q17: Which firms will benefit from a currency