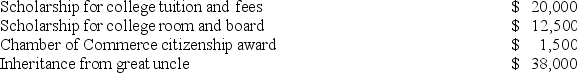

James Dean received the following this year.

Compute James' gross income.

Compute James' gross income.

A) $12,500

B) $14,000

C) $34,000

D) None of the choices are correct.

Correct Answer:

Verified

Q21: An activity will be classified as a

Q25: Real estate taxes deducted for regular tax

Q30: Mr. Lightfoot owns three mortgaged residences that

Q36: Interest paid on debt incurred to acquire,build,or

Q40: Interest paid on home equity debt is

Q42: Ted and Alice divorced this year.Pursuant to

Q46: Which of the following statements about divorce

Q47: Which of the following expenditures is not

Q51: Three years ago, Suzanne bought a new

Q58: Which of the following statements about divorce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents