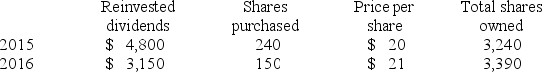

In 2015,Mrs.Owens paid $50,000 for 3,000 shares of a mutual fund and elected to reinvest year-end dividends in additional shares.In 2015 and 2016,she received Form 1099s reporting the following.

If Mrs.Owens sells 1,000 shares in 2017 for $22 per share and uses the average basis method,compute her recognized gain.

If Mrs.Owens sells 1,000 shares in 2017 for $22 per share and uses the average basis method,compute her recognized gain.

A) $4,910

B) $5,333

C) $3,883

D) $0

Correct Answer:

Verified

Q62: Mr. Forest, a single taxpayer, recognized a

Q72: Which of the following statements about Section

Q73: Which of the following statements about an

Q76: In 2001,Mrs.Qualley,contributed $100,000 in exchange for 1,000

Q77: Mr.Quinn recognized a $900 net short-term capital

Q78: Ms.Kerry,who itemized deductions on Schedule A,paid $15,000

Q83: Ms.Watts owns stock in two S corporations,MKP

Q85: Ms.Cowler owns stock in Serzo Inc.,an S

Q94: Ms.Plant owns and actively manages an apartment

Q99: Last year,Mr.Margot purchased a limited interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents