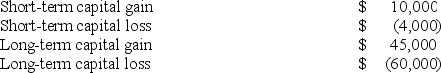

Mr.and Mrs.Philips recognized the following capital gains and losses this year.

Their AGI before consideration of these gains and losses was $140,000.Compute their AGI.

Their AGI before consideration of these gains and losses was $140,000.Compute their AGI.

A) $140,000

B) $131,000

C) $137,000

D) $143,000

Correct Answer:

Verified

Q46: Six years ago, Mr. Ahmed loaned $10,000

Q66: This year,Ms.Kwan recognized a $16,900 net long-term

Q68: Kate recognized a $25,700 net long-term capital

Q70: Frederick Tims,a single individual,sold the following investment

Q72: Which of the following statements about Section

Q73: Which of the following statements about investment

Q74: Ms.Beal recognized a $42,400 net long-term capital

Q76: In 2001,Mrs.Qualley,contributed $100,000 in exchange for 1,000

Q77: Mr.Quinn recognized a $900 net short-term capital

Q78: Ms. Lopez paid $7,260 interest on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents