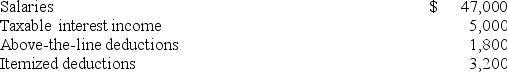

Mr.and Mrs.Liddy,ages 39 and 41,file a joint return and have no dependents for the year.Here is their relevant information.Standard Deduction Table.

Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

A) AGI $50,200; taxable income $29,400.

B) AGI $52,000; taxable income $31,300.

C) AGI $52,000; taxable income $29,400.

D) AGI $50,200; taxable income $40,200.

Correct Answer:

Verified

Q41: Individual taxpayers can obtain an automatic extension

Q42: The unextended due date for the individual

Q57: Mr.Jones and his first wife were legally

Q58: In determining the standard deduction,which of the

Q58: Which of the following statements regarding filing

Q60: Tamara and Todd Goble,ages 66 and 60,file

Q61: Mr.and Mrs.Upton's marginal tax rate on their

Q62: Which of the following statements regarding the

Q63: Ms.Dolan,an unmarried individual,invited her elderly uncle,Martin,to move

Q64: Mr.and Mrs.Kay,ages 68 and 66,file a joint

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents