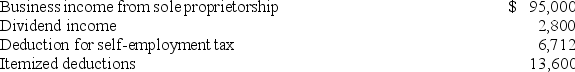

Julie,an unmarried individual,lives in a home with her 13-year-old dependent son,Oscar.This year,Julie had the following tax information.Standard Deduction Table.

Compute Julie's adjusted gross income (AGI) and taxable income.

Compute Julie's adjusted gross income (AGI) and taxable income.

A) AGI $97,800; taxable income $69,388.

B) AGI $97,800; taxable income $76,100.

C) AGI $91,088; taxable income $73,688.

D) AGI $91,088; taxable income $69,388.

Correct Answer:

Verified

Q43: Marie,an unmarried taxpayer,is 26 years old.This year,Marie

Q45: Which of the following taxpayers can't use

Q46: Leon died on August 23,2015,and his wife

Q48: Mr.and Mrs.Dell,ages 29 and 26,file a joint

Q51: Samantha died on January 18,2017.Her husband Dave

Q52: Mr.and Mrs.Warren's AGI last year was $90,300,and

Q52: Mr. Pearl's total income and self-employment tax

Q54: An extension of the time to file

Q57: Mr. and Mrs. Eller's AGI last year

Q80: Which of the following statements regarding the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents