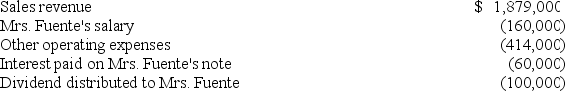

Mrs.Fuente,who has a 39.6% marginal tax rate on ordinary income,is the sole shareholder and CEO of Furey Inc.She also holds a $1 million interest-bearing note issued by Furey.The corporation's current-year financial records show the following:  Compute Mrs.Fuente's tax on her income from Furey.(Ignore payroll taxes in your calculations.)

Compute Mrs.Fuente's tax on her income from Furey.(Ignore payroll taxes in your calculations.)

A) $64,000

B) $95,360

C) $107,120

D) $126,720

Correct Answer:

Verified

Q83: Which of the following statements regarding the

Q83: Kansas Corporation is a 68% shareholder in

Q86: Leo owns 100% of four different corporations.During

Q86: Which of the following benefits does not

Q91: Which of the following statements regarding corporate

Q92: Which of the following statements regarding the

Q92: Which of the following statements regarding the

Q92: Andrews Corporation owns all of the outstanding

Q94: Which of the following is not a

Q97: Mr.Eddy loaned his solely-owned corporation $3,000,000.The corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents