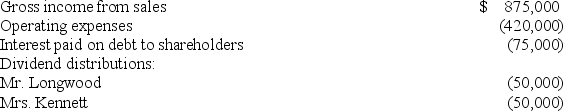

Mr.Longwood and Mrs.Kennett are the equal shareholders in LK Corporation.Both shareholders have a 39.6 percent marginal tax rate on ordinary income.LK's financial records show the following: Corporate tax rate schedule.  a.Compute the combined tax cost for LK,Mr.Longwood,and Mrs.Kennett attributable to LK's operations.

a.Compute the combined tax cost for LK,Mr.Longwood,and Mrs.Kennett attributable to LK's operations.

b.How would your computation change if the interest on the shareholder debt was $175,000 and LK paid no dividends?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Which of the following is not a

Q64: The IRS agent who audited the Form

Q77: Cathy is the President and sole shareholder

Q79: Mr.Allen,whose marginal tax rate is 39.6%,owns an

Q81: Which of the following is not a

Q83: Kansas Corporation is a 68% shareholder in

Q83: Which of the following statements regarding the

Q86: Leo owns 100% of four different corporations.During

Q92: Which of the following statements regarding the

Q92: Which of the following statements regarding the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents