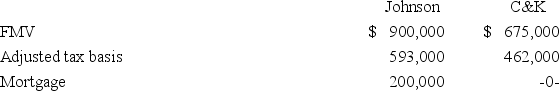

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

A) $200,000 gain recognized; $662,000 basis in Johnson property.

B) No gain recognized; $462,000 basis in Johnson property.

C) No gain recognized; $487,000 basis in Johnson property.

D) None of the choices are correct.

Correct Answer:

Verified

Q55: Nixon Inc. transferred Asset A to an

Q65: Grantly Seafood is a calendar year taxpayer.In

Q66: Perry Inc.and Dally Company entered into an

Q69: Johnson Inc.and C&K Company entered into an

Q71: Thieves stole computer equipment used by Ms.James

Q71: Babex Inc.and OMG Company entered into an

Q72: Grantly Seafood is a calendar year taxpayer.In

Q72: Which of the following statements about the

Q76: In June,a fire completely destroyed office furniture

Q77: In March,a flood completely destroyed three delivery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents