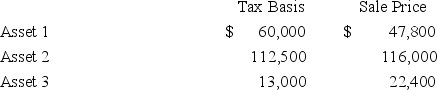

Gupta Company made the following sales of capital assets this year.

What is the effect of the three sales on Gupta's taxable income?

What is the effect of the three sales on Gupta's taxable income?

A) $700 increase

B) $12,900 increase

C) No effect

D) None of the choices are correct

Correct Answer:

Verified

Q61: Andrew sold IBM stock to his sister

Q66: Nilex Company sold three operating assets this

Q72: Rizzi Corporation sold a capital asset with

Q74: Mr.Quick sold marketable securities with a $112,900

Q77: Fantino Inc.was incorporated in 2015 and adopted

Q78: Mr.and Mrs.Sykes operate a very profitable small

Q83: Kuong Inc. sold a commercial office building

Q83: Mr.and Mrs.Marley operate a small business.This year,the

Q86: Which of the following assets is not

Q87: Bastrop Inc. generated a $169,000 ordinary loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents