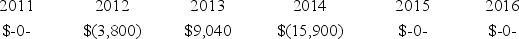

Proctor Inc.was incorporated in 2011 and adopted a calendar year.Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2016.

In 2017,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

In 2017,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

A) $25,000 Section 1231 gain.

B) $19,700 ordinary gain and $5,300 Section 1231 gain.

C) $15,900 ordinary gain and $9,100 Section 1231 gain.

D) $25,000 ordinary gain.

Correct Answer:

Verified

Q63: In its current tax year, PRS Corporation

Q81: Mr and Mrs Churchill operate a small

Q81: Nancy owned business equipment with a $16,950

Q84: This year, Izard Company sold equipment purchased

Q91: Several years ago, Nipher paid $70,000 to

Q93: B&I Inc.sold a commercial office building used

Q94: Delour Inc.was incorporated in 2011 and adopted

Q100: This year,Adula Company sold equipment purchased in

Q101: Mrs.Tinker paid $78,400 to purchase 15,000 shares

Q113: Two months ago, Dawes Inc. broke a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents