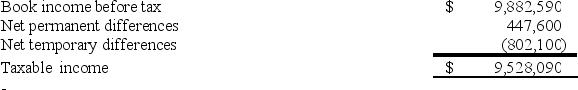

B&B Inc.'s taxable income is computed as follows.  Using a 34% rate,compute B&B's tax expense per books and tax payable.

Using a 34% rate,compute B&B's tax expense per books and tax payable.

A) Tax expense per books $3,360,081; tax payable $3,239,551.

B) Tax expense per books $3,512,265; tax payable $3,239,551.

C) Tax expense per books $3,512,265; tax payable $3,512,265.

D) Tax expense per books $3,087,367; tax payable $3,087,367.

Correct Answer:

Verified

Q42: Which of the following statements about the

Q54: Why does the federal tax law disallow

Q56: Which of the following business expenses always

Q57: Pim Inc. operates a business with a

Q57: Toro Inc.received permission from the IRS to

Q62: Eaton Inc.is a calendar year,cash basis taxpayer.On

Q64: Which of the following statements describes a

Q66: Addis Company operates a retail men's clothing

Q68: According to your textbook, business managers prefer

Q72: Which of the following statements about the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents