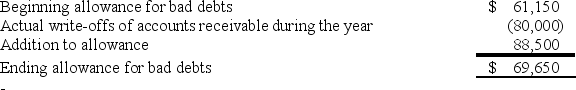

Monro Inc.uses the accrual method of accounting.Here is a reconciliation of Monro's allowance for bad debts for the current year.  Because of the difference between the GAAP and the tax rules for accounting for bad debts,Monro Inc.has an:

Because of the difference between the GAAP and the tax rules for accounting for bad debts,Monro Inc.has an:

A) $8,500 permanent excess of book income over taxable income.

B) $8,500 permanent excess of taxable income over book income.

C) $8,500 temporary excess of taxable income over book income.

D) $8,500 temporary excess of book income over taxable income.

Correct Answer:

Verified

Q105: Earl Company uses the accrual method of

Q106: Which of the following statements about an

Q107: Earl Company uses the accrual method of

Q108: Krasco Inc.'s auditors prepared the following reconciliation

Q109: Ladow Inc.incurred a $32,000 net operating loss

Q111: Monro Inc.uses the accrual method of accounting.Here

Q112: Zephex is a calendar year corporation.On December

Q113: Assuming a 30% marginal tax rate,compute the

Q114: Slumar,an accrual basis,calendar year corporation,reported $7,289,200 net

Q115: Which of the following statements about the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents