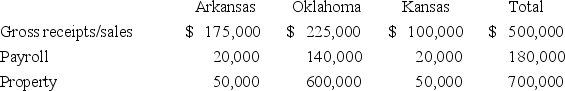

Tri-State's,Inc.operates in Arkansas,Oklahoma,and Kansas.Assume that each state has adopted the UDITPA formula.During the corporation's tax year ended December 31,the apportionment data indicated:

Tri-State's income for the current year is $250,000.Approximately how much will be taxed by Kansas?

Tri-State's income for the current year is $250,000.Approximately how much will be taxed by Kansas?

A) $83,000

B) $95,000

C) $32,000

D) $170,000

Correct Answer:

Verified

Q42: The term "tax haven" refers to a

Q45: Korn, Co. was incorporated in Delaware. It

Q48: This year,Sutton Corporation's before-tax income was $2,000,000.It

Q48: Which of the following statements about the

Q51: Lexington Corporation conducts business in four states.

Q51: Harris Corporation's before-tax income was $400,000.It does

Q53: GAAP-based consolidated financial statements include only income

Q53: Verdi Inc.has before-tax income of $500,000.Verdi operates

Q54: A foreign source dividend received by a

Q55: Economic nexus:

A) May exist even though a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents