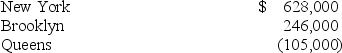

New York,Inc.owns 100% of Brooklyn,Inc.and Queens,Inc.Taxable income for the three corporations for their first year was as follows:

Which of the following statements is false?

Which of the following statements is false?

A) Consolidated taxable income is $769,000.

B) If a consolidated return is filed,Queens,Inc.will receive immediate tax benefit from its operating loss.

C) If Brooklyn,Inc.is a foreign corporation,it can be part of a consolidated return.

D) The corporations are not required to file a consolidated tax return if they are an affiliated group; however,they may elect to do so.

Correct Answer:

Verified

Q28: Angel Corporation's current-year regular tax liability is

Q29: A corporation that is unable to meet

Q34: For a consolidated group of corporations,Schedule M-3

Q39: The domestic production activities deduction is a

Q40: AMT adjustments can only increase a corporation's

Q43: Sonic Corporation has a 35% marginal tax

Q44: In its first taxable year,Platform,Inc.generated a $200,000

Q55: Which of the following is a primary

Q56: The stock of Wheel Corporation, a U.S.

Q58: Aaron, Inc. is a nonprofit corporation that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents