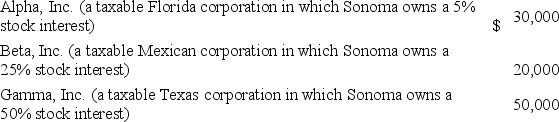

This year,Sonoma Corporation received the following dividends:

Before considering the above dividends,Sonoma has taxable income of $550,000.Calculate Sonoma's allowable dividends-received deduction and taxable income.

Before considering the above dividends,Sonoma has taxable income of $550,000.Calculate Sonoma's allowable dividends-received deduction and taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Which of the following statements regarding Schedule

Q81: Torquay Inc.'s 2016 taxable income was $9,782,200,and

Q82: For its current tax year,Volcano,Inc.reported the following:

Q83: Silver Bullet Inc.reported the following for its

Q84: Which of the following statements about the

Q86: Alexus Inc.'s alternative minimum taxable income before

Q88: Aloha,Inc.had the following results for its first

Q89: Corporation F owns 95 percent of the

Q90: Harmon,Inc.was incorporated and began business on January

Q94: Which of the following is a means

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents