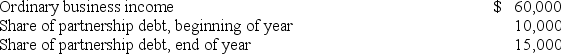

Gavin owns a 50% interest in London Partnership.His tax basis in his partnership interest at the beginning of the year was $20,000.His partnership Schedule K-1 showed the following:

Calculate Gavin's tax basis in his partnership interest at the end of the year?

Calculate Gavin's tax basis in his partnership interest at the end of the year?

A) $85,000

B) $95,000

C) $75,000

D) $65,000

Correct Answer:

Verified

Q71: Which of the following statements regarding limited

Q77: Funky Chicken is a calendar year general

Q78: Alex is a partner in a calendar

Q79: Perry is a partner in a calendar

Q80: At the beginning of year 1, Paulina

Q81: Bevo Partnership had the following financial activity

Q82: At the beginning of 2017,Quentin purchased a

Q82: On January 1, Leon purchased a 10%

Q85: On January 1,2017,Laura Wang contributed $30,000 cash

Q97: Which of the following statements regarding S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents