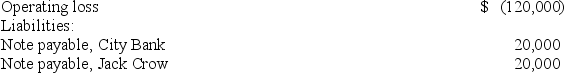

Orange,Inc.is a calendar year partnership with the following current year information:

On January 1,John James bought 50% general interest in Orange,Inc.for $30,000.How much of the operating loss may John deduct on his Form 1040?

On January 1,John James bought 50% general interest in Orange,Inc.for $30,000.How much of the operating loss may John deduct on his Form 1040?

A) $60,000

B) $30,000

C) $40,000

D) $50,000

Correct Answer:

Verified

Q42: Which of the following amounts are not

Q63: Cramer Corporation and Mr. Chips formed a

Q64: Bernard and Leon formed a partnership on

Q65: Max is a 10% limited partner in

Q68: Which of the following statements regarding the

Q69: George and Martha formed a partnership by

Q70: Cramer Corporation and Mr. Chips formed a

Q72: Cramer Corporation and Mr. Chips formed a

Q73: Which of the following statements about S

Q74: Jackie contributed $60,000 in cash to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents