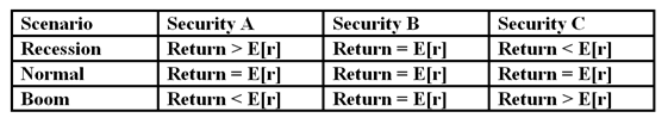

Based on the outcomes in the table below choose which of the statements is/are correct:  I. The covariance of Security A and Security B is zero

I. The covariance of Security A and Security B is zero

II. The correlation coefficient between Security A and C is negative

III. The correlation coefficient between Security B and C is positive

A) I only

B) I and II only

C) II and III only

D) I, II and III

Correct Answer:

Verified

Q4: Risk that can be eliminated through diversification

Q8: Asset A has an expected return of

Q12: The risk that can be diversified away

Q13: The correlation coefficient between two assets is

Q13: Firm-specific risk is also called _ and

Q15: You put half of your money in

Q18: Suppose that a share portfolio and a

Q18: Adding additional risky assets to the investment

Q28: The standard deviation of return on investment

Q45: A measure of the riskiness of an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents