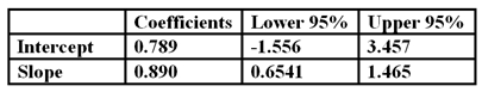

You run a regression of a share's returns versus a market index and find the following:  Based on the data you know that the share

Based on the data you know that the share

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

Correct Answer:

Verified

Q25: In a single factor market model the

Q27: Security A has an expected rate of

Q28: An important characteristic of market equilibrium is

Q34: The most significant conceptual difference between the

Q41: Standard deviation of portfolio returns is a

Q42: Arbitrage is _.

A) is an example of

Q43: According to the CAPM,investors are compensated for

Q57: The variance of the return on the

Q59: The measure of unsystematic risk can be

Q62: One of the main problems with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents