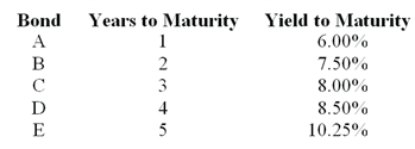

Consider the following $1 000 par value zero-coupon bonds:  The expected one-year interest rate two years from now should be ________.

The expected one-year interest rate two years from now should be ________.

A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

Correct Answer:

Verified

Q12: According to the liquidity preference theory of

Q17: TIPS offer investors inflation protection by increasing

Q18: Consider two bonds, A and B. Both

Q21: A _ bond is a bond where

Q24: A Treasury bond due in one year

Q25: Consider the expectations theory of the term

Q25: A coupon bond which pays interest annually,

Q26: A convertible bond has a par value

Q30: Everything else equal _ bonds will require

Q60: A zero-coupon bond has a yield to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents