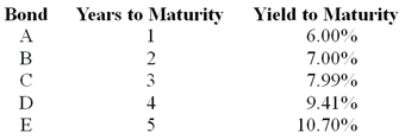

Consider the following $1 000 par value zero-coupon bonds:  The expected one-year interest rate four years from now should be ________.

The expected one-year interest rate four years from now should be ________.

A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

Correct Answer:

Verified

Q53: You can be sure that a bond

Q56: A 6% coupon US Treasury note pays

Q66: If the price of a $10,000 par

Q69: A discount bond that pays interest semiannually

Q72: A corporate bond has a 10-year maturity

Q76: Assuming semiannual compounding,a 20-year zero coupon bond

Q78: The yield to maturity on a bond

Q82: A bond was purchased at a premium

Q87: A bond has a 5% coupon rate.The

Q89: An investor pays $989.40 for a bond.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents