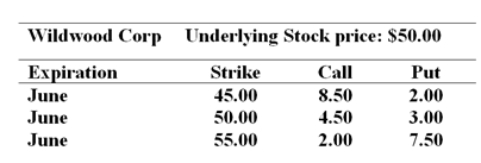

You are cautiously bullish on the common share of the Wildwood Corporation over the next several months. The current price of the share is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:  Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

A) $1 050

B) $650

C) $400

D) $400 income rather than cost

Correct Answer:

Verified

Q29: What strategy could be considered insurance for

Q30: Before expiration the time value of an

Q32: You own $75 000 worth of stock

Q33: Suppose you write a strap and the

Q35: You sell one Hewlett Packard August 50

Q36: The value of a call option increases

Q37: Investor A bought a call option and

Q39: A 45 call option on a share

Q41: A put on Sanders stock with a

Q47: You buy one Hewlett Packard August 50

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents