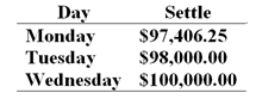

On Monday morning you sell one June T-bond futures contract at 97: 27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  At the close of day Tuesday your cumulative rate of return on your investment is

At the close of day Tuesday your cumulative rate of return on your investment is

A) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

Correct Answer:

Verified

Q46: On Monday morning you sell one June

Q51: A one-year gold futures contract is selling

Q69: Interest rate swaps involve the exchange of

Q73: You purchase an interest rate futures contract

Q75: You own a $15 million bond portfolio

Q76: Sahali Trading Company has issued $100 million

Q76: From the perspective of determining profit and

Q81: A market timer now believes that the

Q86: A corporation will be issuing bonds in

Q89: A farmer sells futures contracts at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents