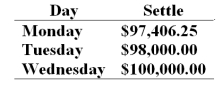

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

-If rf is greater than d then we know that _______________.

A) the futures price will be higher as contract maturity increases

B) F0 < S0

C) FT > ST

D) arbitrage profits are possible

Correct Answer:

Verified

Q55: A long hedger will _ from an

Q59: Approximately _ of futures contracts result in

Q61: On Monday morning you sell one June

Q62: On Monday morning you sell one June

Q63: On Monday morning you sell one June

Q66: On Monday morning you sell one June

Q67: The use of leverage is practiced in

Q69: Interest rate swaps involve the exchange of

Q72: The _ contract dominates trading in stock-index

Q77: The _ and the _ have the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents