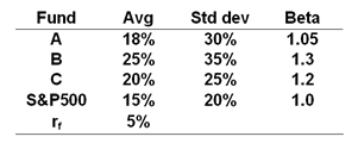

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?

A) 0.43%

B) 1.25%

C) 1.77%

D) 1.43%

Correct Answer:

Verified

Q1: Consider the Sharpe and Treynor performance measures.When

Q2: The comparison universe is _.

A) the bogey

Q9: Your return will generally be higher using

Q10: Which one of the following performance measures

Q12: The risk free rate, average returns, standard

Q15: Suppose that over the same period two

Q15: Henriksson found that,on average,betas of funds _

Q16: The risk-free rate, average returns, standard deviations

Q29: Perfect timing ability is equivalent to having

Q33: The M2 measure of portfolio performance was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents