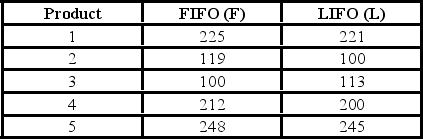

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the null hypothesis?

What is the null hypothesis?

A) H0: µd = 0

B) H0: µd ≠ 0

C) H0: µd ≤ 0

D) H0: µd ≥ 0

Correct Answer:

Verified

Q50: An investigation of the effectiveness of a

Q51: A company is researching the effectiveness of

Q52: Accounting procedures allow a business to evaluate

Q53: An investigation of the effectiveness of a

Q54: Accounting procedures allow a business to evaluate

Q56: The results of a mathematics placement exam

Q57: Consider independent simple random samples that are

Q58: An investigation of the effectiveness of a

Q59: When testing the hypothesized equality of two

Q60: A company is researching the effectiveness of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents