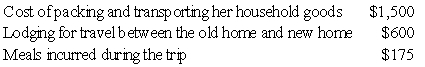

Rena had the following moving expenses during 2014:  Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2014 return?

Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2014 return?

A) $2,275.

B) $2,100.

C) $1,675.

D) $ 600.

Correct Answer:

Verified

Q29: Under a court-ordered decree of separate maintenance

Q32: For the deduction of self-employment taxes,which of

Q35: For a taxpayer to be eligible to

Q38: In 2010 through 2013,Rory borrowed a total

Q39: Charde,who is single,had a student loan for

Q41: Sharon is a self-employed hair stylist and

Q46: The percentage of self-employed health insurance premiums

Q48: All of the following are requirements for

Q57: Which of the following is not deductible

Q60: An early withdrawal penalty is reported on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents