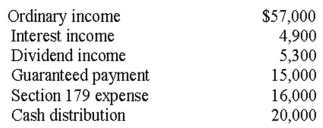

Partner Spence had the following items reported on a partnership Schedule K-1:  Spence had a basis in his partnership interest of $23,000 at the beginning of the year.What is Spence's basis in his partnership interest at the end of the year?

Spence had a basis in his partnership interest of $23,000 at the beginning of the year.What is Spence's basis in his partnership interest at the end of the year?

A) $21,000.

B) $31,200.

C) $54,200.

D) $70,200.

Correct Answer:

Verified

Q41: Paris,a 60% partner in Omega Partnership,has a

Q43: In 2013,Angel contributes land to a partnership

Q44: A partner had the following items reported

Q45: Which of the following items increases a

Q48: Sabrina has a $12,000 basis in her

Q49: In 2013,Angel contributes land to a partnership

Q49: Parker,a 25% partner in Delta Partnership,has a

Q51: The general rule regarding income and expense

Q53: As a general rule,a distribution to a

Q56: Rental income and expenses are treated as:

A)Ordinary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents