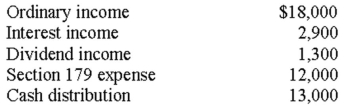

Partner Tami (a 20% partner) had the following items reported to her on a partnership Schedule K-1:  Tami had a basis in her partnership interest of $14,000 at the beginning of the year.Additionally,the partnership has recourse liabilities of $100,000 outstanding at the end of the year.What is Tami's basis in her partnership interest at the end of the year?

Tami had a basis in her partnership interest of $14,000 at the beginning of the year.Additionally,the partnership has recourse liabilities of $100,000 outstanding at the end of the year.What is Tami's basis in her partnership interest at the end of the year?

A) $7,000.

B) $11,200.

C) $23,200.

D) $31,200.

Correct Answer:

Verified

Q21: If Josh's partnership basis was $5,000 and

Q35: Which of the following is reported as

Q38: Lacy contributes the following assets to a

Q38: A pre-contribution gain occurs when a partner

Q39: Bethany contributes a building to a partnership

Q41: Paris,a 60% partner in Omega Partnership,has a

Q42: Sabrina has a $12,000 basis in her

Q43: In 2013,Angel contributes land to a partnership

Q44: A partner had the following items reported

Q53: As a general rule,a distribution to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents