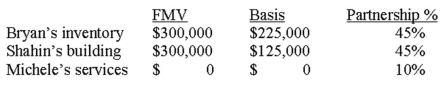

Bryan,Shahin,and Michele form a partnership.Bryan and Shahin contribute inventory and a building,respectively.Michele agrees to perform all of the accounting and office work in exchange for a 10% interest.  a.Do any of the partners recognize any gain? If so,how much and why?

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership of each asset?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Partner Jamie has a basis of $10,000

Q52: A partnership has $23,000 of depreciation expense

Q55: Which of the following items decreases a

Q57: A partner had the following items reported

Q61: Callie contributes the following assets to a

Q62: Anna has a $25,000 basis in her

Q64: On April 30 of the current year,Ashley

Q65: Jose purchased a 30% partnership interest for

Q66: Marty and Blake are equal partners in

Q68: Jeremy and Juan are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents