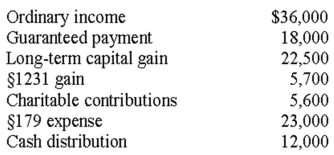

Rita has a beginning basis in a partnership of $43,000.Rita's share of income and expense from the partnership consists of the following amounts:  a.What items are separately stated?

a.What items are separately stated?

b.What is Rita's self-employment income?

c.Calculate Rita's partnership basis at the end of the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Molly has a $15,000 basis in her

Q62: Anna has a $25,000 basis in her

Q65: Jose purchased a 30% partnership interest for

Q66: Marty and Blake are equal partners in

Q68: Charley is a partner in Charley,Austin,Liz &

Q69: Latesha contributes a building with a FMV

Q69: When dealing with the liquidation of a

Q71: Doug,Geoffrey,and Fredrick form a partnership and contribute

Q75: Cameron has a basis in his partnership

Q75: Calvin purchased a 30% partnership interest for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents