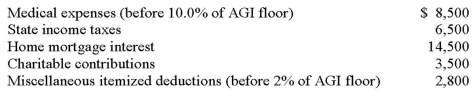

Antonio reported the following itemized deductions on his 2014 tax return.His AGI for 2014 was $95,000.The mortgage interest is all qualified mortgage interest to purchase his personal residence.For AMT,compute his total adjustment for itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: In 2014,Ethan contributes cash of $50,000 and

Q63: Jordan purchased a warehouse for $600,000.$100,000 of

Q64: Terence and Alfred each invested $10,000 cash

Q64: In 2010,Lindsay's at-risk amount was $50,000 at

Q66: Elijah owns an apartment complex that he

Q68: Baird has four passive activities.The following income

Q68: Identify factors that increase or decrease the

Q70: In 2014,Nigel contributes cash of $10,000 in

Q72: Sarah is single with no dependents.During 2014,Sarah

Q73: Cory sells his entire interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents