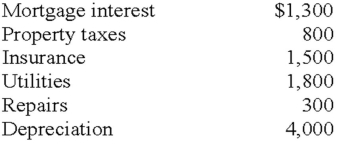

Jacqueline owns a condominium on an island in Washington which was rented out all year for $30,000.She incurred the following expenses:  What amount of net income or loss does Jacqueline report from this rental property?

What amount of net income or loss does Jacqueline report from this rental property?

A) $0

B) $9,700 net loss

C) $20,300 net income

D) $30,000 net income

Correct Answer:

Verified

Q23: Rental properties that are also used as

Q36: If a tenant provides service for the

Q42: If a taxpayer materially participates in a

Q45: In the current year,Marnie rented her vacation

Q46: Hugh and Mary own a cabin in

Q47: Lupe rented her personal residence for 13

Q48: Mario owns a home in Park City,Utah,that

Q49: Brad and Kate received $9,500 for rent

Q52: Charles and Sarah own a home in

Q59: What is the proper tax treatment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents