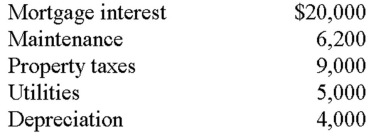

Nathan owns a tri-plex in Santa Maria,California.He lives in one and rents the other two remaining units.All three units are identical.He incurred the following expenses for the entire building:  How much in rental expenses can Nathan deduct against the rental income on a Schedule E in the current year (without considering any passive loss limitations) ? (Round your answers to the nearest whole dollar)

How much in rental expenses can Nathan deduct against the rental income on a Schedule E in the current year (without considering any passive loss limitations) ? (Round your answers to the nearest whole dollar)

A) $14,733

B) $20,000

C) $29,467

D) $44,200

Correct Answer:

Verified

Q41: Jane and Don own a ski chalet

Q43: Which of the following expense items is(are)deductible

Q53: Which of the following statements is not

Q55: A property that has been rented for

Q60: Which of the following is not considered

Q62: Which of the following statements is incorrect

Q63: Ariel,Bob,Candice and Dmitri are equal partners in

Q65: Eddie and Camilla received $11,600 for the

Q71: From which of the following flow-through entities

Q74: Darius and Chantal own a cabin in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents