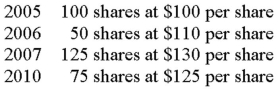

Keisha sold 200 shares of Chic-Chic stock in 2014 for $22,500 and received a 1099-B to record the sale of the shares.Keisha's investment portfolio includes the following purchases of Chic-Chic's stock:  Assuming Keisha does not identify which shares she sold,she will recognize

Assuming Keisha does not identify which shares she sold,she will recognize

A) no gain or loss.

B) $500 gain.

C) $1,000 loss.

D) $3,125 loss.

Correct Answer:

Verified

Q69: All of the following statements regarding Section

Q75: The following is true if land is

Q77: On May 1,2013,Kelalani purchased land for $98,000

Q78: In 2008,Naila purchased land for $77,000 for

Q79: Sylvio purchased an apartment building as an

Q81: Gabriella,a single taxpayer,has wage income of $160,000.In

Q82: Yolanda,a single taxpayer,has W-2 income of $87,500.She

Q84: Jack purchased 100 shares of Ford stock

Q85: In 2011,Joe purchased land for $73,500 for

Q87: Which of the following is a Section

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents