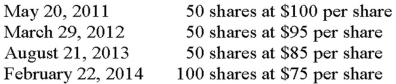

Dan sold 135 shares (assume 100 are long-term) of Elite Mutual Fund on July 26,2014 for $95 per share and received a 1099-B (box 3 was not checked for basis) to record the sale of the shares.Dan's investment portfolio includes the following purchases of Elite Mutual Fund:  In 2014,Dan will recognize:

In 2014,Dan will recognize:

A) no long-term gain or loss and a $333.45 short-term gain.

B) $315 short-term gain and a $900 long-term gain.

C) $250 long term loss and $583.45 short-term gain.

D) no short-term gain or loss and a $1,215 long-term gain.

Correct Answer:

Verified

Q62: Josephine gave her son,Shane 700 shares of

Q65: In 2005,Savannah purchased 200 shares of Hi-Style

Q65: Francisco sells a parcel of land for

Q67: Diane gifted 100 shares of Runners Link

Q67: Anike received property as part of an

Q70: A taxpayer purchased land in 2012 for

Q71: Joe received a parcel of land as

Q72: Which of the following is Section 1231

Q80: Which of the following statements is incorrect

Q98: Which one of the following is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents