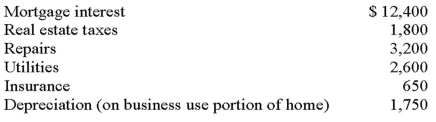

Chris runs a business out of her home.She uses 500 square feet of her home exclusively for the business.Her home is 2500 square feet in total.Chris had $36,000 of business revenue and $32,000 of business expenses from her home business.The following expenses relate to her home:  What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

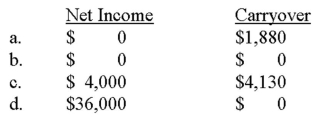

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Q30: Which expenses incurred in a trade or

Q31: Education expenses are deductible if the education

Q37: In June 2014,Kelly purchased new equipment for

Q38: On July 15,2012,Travis purchased some office furniture

Q39: §179 expense is available for all of

Q43: Cole purchased a car for business and

Q44: Shante is employed by a local pharmaceutical

Q50: In order for an employee to deduct

Q59: Which of the following properties is not

Q60: The standard mileage rate encompasses all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents