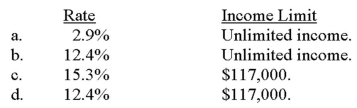

For 2014,what is the social security tax rate and income limit for a self-employed individual?

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Q42: If an activity is considered a hobby,which

Q43: Cole purchased a car for business and

Q44: Shante is employed by a local pharmaceutical

Q48: Marcus has two jobs.He works as a

Q49: Byron took a business trip from Philadelphia

Q50: In order for an employee to deduct

Q50: Katherine earned $100,000 from her job at

Q51: Marion drives 20 miles a day from

Q59: Which of the following properties is not

Q60: The standard mileage rate encompasses all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents