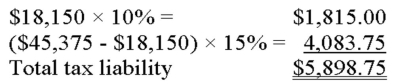

Jordan and Paul,a married couple,have taxable income of $45,375 which is taxed as follows:  Their average tax rate is:

Their average tax rate is:

A) 10%.

B) 12.5%.

C) 13%.

D) 15%.

Correct Answer:

Verified

Q29: Rev.Proc.87-56 was the 56th Revenue Procedure issued

Q34: For equivalent amounts of gross income,a single

Q37: One major disadvantage the taxpayer has when

Q47: The average tax rate is the taxable

Q47: Jordan and Paul,a married couple,have taxable income

Q49: The amount of tax liability calculated using

Q51: Which of the following would disqualify a

Q54: Legislative regulations do not have the full

Q64: Which of the following would disqualify a

Q116: A tax rate that increases as the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents