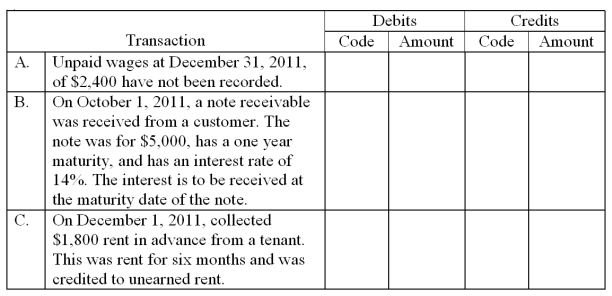

Lane Company is completing the accounting cycle at the end of its annual accounting period,December 31,2011.No adjusting entries have been made during the year so three adjusting entries must be made to update the accounts.The following accounts,selected from the company's chart of accounts,are to be used for this purpose.They are coded to the left for easy reference. You are to indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2011.

Correct Answer:

Verified

Q88: Which of the following account balances would

Q98: Which of the following accounts would most

Q100: Which of the following will result in

Q101: Below are two related transactions for Golden

Q102: The comparative balance sheets of Titan

Q104: Four transactions are given below that

Q105: Below are four transactions that were

Q106: On December 1,2011,Fleet Company paid $30,000 for

Q107: Johnson Corporation is completing the accounting

Q108: Center Company is completing the accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents