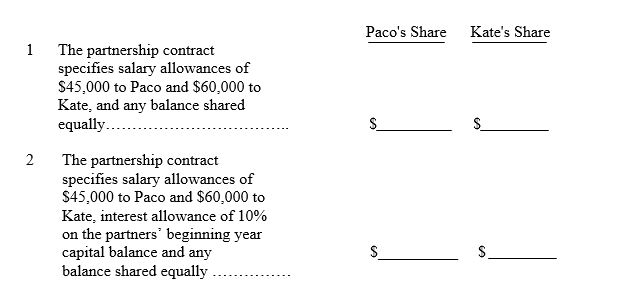

Paco and Kate invested $99,000 and $126,000,respectively,in a partnership they began one year ago.Assuming the partnership earned $120,000 during the current year; compute the share of the net income each partner should receive under each of these independent assumptions.

Correct Answer:

Verified

Q86: Jane, Castle, and Sean are dissolving their

Q87: Nee High and Low Jack are partners

Q89: Kathleen Reilly and Ann Wolf decide to

Q98: Basketball Products LP is organized as a

Q98: Identify and discuss the key characteristics of

Q110: Durango and Verde formed a partnership with

Q112: Arthur, Barnett, and Cummings form a partnership.

Q123: How are partners' investments in a partnership

Q128: Explain the steps involved in the liquidation

Q133: What are the ways a partner can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents