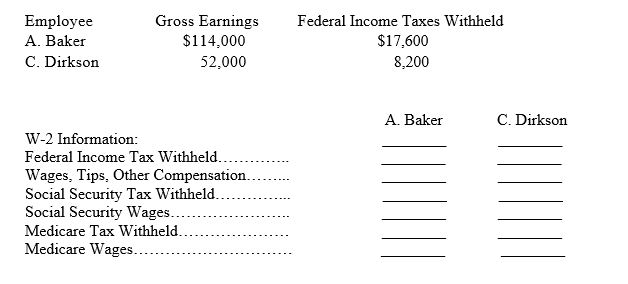

A company's employer payroll tax rates are 0.8% for federal unemployment taxes,5.4% for state unemployment taxes,6.2% for FICA social security taxes on earnings up to $106,800,and 1.45% for FICA Medicare taxes on all earnings.Compute the W-2 Wage and Tax Statement information required below for the following employees:

Correct Answer:

Verified

Q142: A company sells its product subject to

Q143: A company sells computers with a 6-month

Q144: Pastimes Co. offers its employees a bonus

Q148: A company sells personal computers for $2,300

Q159: An employer has an employee benefit package

Q160: _ are obligations due within one year

Q167: The payroll records of a company provided

Q175: Halo Company provides you with following information

Q181: _are probable future payments of assets

Q198: A _ is a potential obligation that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents