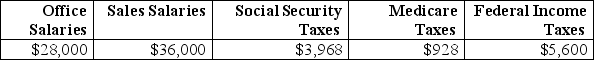

Frado Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.

a.Recorded the March payroll using the payroll register information given above.

a.Recorded the March payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the March payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is .8%.

c.Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

Correct Answer:

Verified

Q143: A company sells computers with a 6-month

Q148: A company sells personal computers for $2,300

Q158: Arena Sports receives $31,680,000 cash in advance

Q160: _ are obligations due within one year

Q170: _ allowances are items that reduce the

Q175: Halo Company provides you with following information

Q175: _ are banks authorized to accept deposits

Q181: _are probable future payments of assets

Q195: Contingent liabilities are recorded in the accounts

Q201: Employer payroll taxes are an added employee

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents