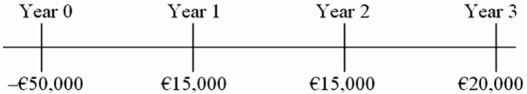

Consider the following international investment opportunity:  The current exchange rate is $1.60 = €1.00.The inflation rate in the U.S.is 3 percent and in the euro zone 2 percent.The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent.

The current exchange rate is $1.60 = €1.00.The inflation rate in the U.S.is 3 percent and in the euro zone 2 percent.The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent.

Find the dollar cash flows to compute the dollar-denominated NPV of this project.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Given the following information for a

Q60: Which of the following statements is false

Q61: Your firm is based in southern Ireland

Q62: Your firm is based in southern Ireland

Q63: Consider the following international investment opportunity.It involves

Q65: Consider the following international investment opportunity.It involves

Q66: Consider the following international investment opportunity.It involves

Q67: Consider the following international investment opportunity.It involves

Q68: A French firm is considering a one-year

Q69: Consider the following international investment opportunity:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents