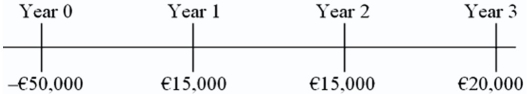

Consider the following international investment opportunity:  The current exchange rate is $1.60 = €1.00.The inflation rate in the U.S.is 3 percent and in the euro zone 2 percent.The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent.

The current exchange rate is $1.60 = €1.00.The inflation rate in the U.S.is 3 percent and in the euro zone 2 percent.The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent.

What is the euro-denominated IRR of this project?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: A French firm is considering a one-year

Q69: Consider the following international investment opportunity:

Q70: Your firm is based in southern Ireland

Q71: Your firm is based in southern Ireland

Q72: Consider the following international investment opportunity:

Q74: Consider the following international investment opportunity.It involves

Q75: Consider the following international investment opportunity.It involves

Q76: A French firm is considering a one-year

Q77: Your firm is based in southern Ireland

Q78: Consider the following international investment opportunity.It involves

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents