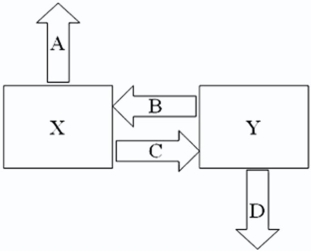

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for;

A = Company X's external borrowing rate

B = Company Y's payment to X (rate) C = Company X's payment to Y (rate) D = Company Y's external borrowing rate

A.A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B.A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C.A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D.A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Q29: Company X wants to borrow $10,000,000

Q30: Floating-for-floating currency swaps

A)have different reference rates for

Q31: A is a U.S.-based MNC with

Q32: Consider the dollar- and euro-based borrowing

Q33: When an interest-only swap is established on

Q35: Company X wants to borrow $10,000,000

Q36: Suppose ABC Investment Banker Ltd.,is quoting swap

Q37: Company X wants to borrow $10,000,000

Q38: Compute the payments due in the

Q39: Use the following information to calculate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents