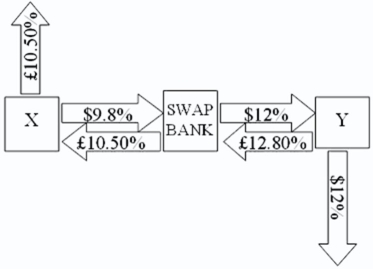

Company X wants to borrow $10,000,000 for 5 years; company Y wants to borrow £5,000,000 for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are shown here: A swap bank proposes the following interest only swap:

X will pay the swap bank annual payments on $10,000,000 with the coupon rate of 9.80 percent; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5 percent.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12 percent.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will earn 10 basis points per year; the only risk is default risk.

B) The swap bank will earn 10 basis points per year but has exchange rate risk: dollar-denominated income and pound-denominated costs and default risk.

C) The swap bank will earn 10 basis points per year but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk.

D) The swap bank will earn 20 basis points per year in dollars but has exchange rate risk: pound-denominated income and dollar-denominated costs and default risk.

Correct Answer:

Verified

Q24: Consider the dollar- and euro-based borrowing

Q25: Company X wants to borrow $10,000,000

Q26: In a currency swap,

A)it may be the

Q27: Compute the payments due in the

Q28: Swaps are said to offer market completeness.

A)This

Q30: Floating-for-floating currency swaps

A)have different reference rates for

Q31: A is a U.S.-based MNC with

Q32: Consider the dollar- and euro-based borrowing

Q33: When an interest-only swap is established on

Q34: Company X wants to borrow $10,000,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents