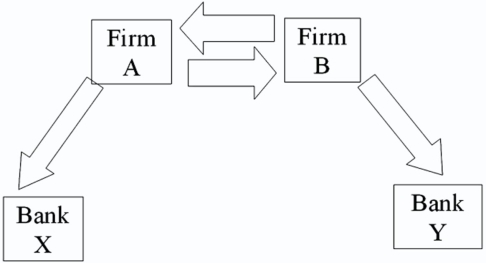

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.

Correct Answer:

Verified

Q67: Suppose that the swap that you proposed

Q68: Consider the situation of firm A

Q69: Suppose that you are a swap

Q70: With regard to a swap bank acting

Q71: Come up with a swap (principal

Q73: Suppose that you are a swap

Q74: Suppose that the swap that you proposed

Q75: Come up with a swap (exchange

Q76: Consider the situation of firm A

Q77: With regard to a swap bank acting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents