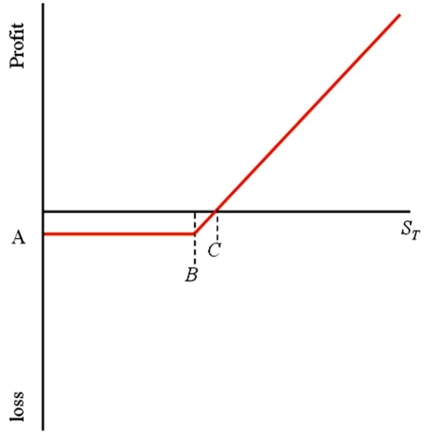

Consider this graph of a call option.The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125.What are the values of A,B,and C,respectively?

A) A = $3,125 (or $.05 depending on your scale) ; B = $1.50; C = $1.55

B) A = €3,750 (or €.06 depending on your scale) ; B = $1.50; C = $1.55

C) A = $.05; B = $1.55; C = $1.60

D) none of the options

Correct Answer:

Verified

Q23: A European option is different from an

Q24: The current spot exchange rate is

Q25: If you think that the dollar is

Q26: Which of the lines is a graph

Q27: With currency futures options the underlying asset

Q29: Most exchange traded currency options

A)mature every month,with

Q30: In the CURRENCY TRADING section of The

Q31: From the perspective of the writer of

Q32: The current spot exchange rate is

Q33: An investor believes that the price of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents